In my last article I described how the desire of European nations after World War II to prevent future conflicts led to increasing co-operation and integration with the ultimate formation of the European Union and the single European currency. I looked at how, despite this having significant benefits, the ‘one size fits all’ policy was risky, tying nations at different stages of economic cycles to a fixed interest rate that could either prevent growth or over-stimulate economies. The financial crisis of the last four years has exposed the weaknesses in this system and the next three months are going to be very interesting indeed. So what is going to happen next?

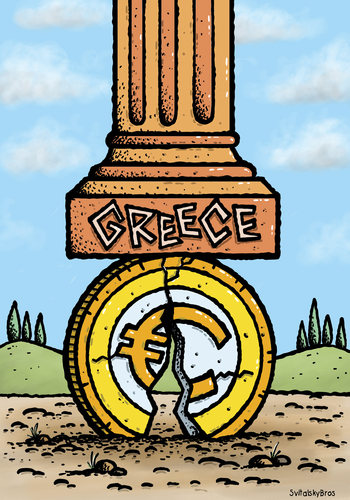

The leaders of the Euro-zone countries agreed a fiscal pact in 2011 based on austerity. Countries agreed to reduce their government deficits largely by spending less. Weaker countries, such as Greece, have received financial support from other countries in return for agreeing to rein in spending by increasing retirement ages, cutting public service jobs and reducing salaries. This has not been popular with the Greek public and their government has had to call an election. The public wants to stay in the Euro-zone but does not want such harsh austerity measures - over half of young Greeks are out of work. As one commentator put it: “the Greeks want to be in the club but not pay the membership fees”. Further elections next month will probably be won by the Syriza block who reject the agreed fiscal package. Greek exit from the Euro-zone, which some people are calling ‘Grexit’, the return of the Drachma currency and a default on debt is then likely.To add to German leader Angela Merkel’s misery is the fact that recent French elections have brought Francois Hollande to the presidency. He thinks that growth is more important than austerity - spend more to stimulate growth which in turn pays off debt. He wants to renegotiate the fiscal pact terms. All this is making the financial markets very jittery and if there is one thing that destabilises this sort of situation it is uncertainty, which is often closely followed by panic.

Just look at Spain this week where personal savers have withdrawn large amounts of their deposits as they believe that the Bancia bank may go out of business due to bad debt. Spain, along with Portugal and Ireland, are all weak Euro-zone currencies that could be at risk of having to leave the Euro. Even Italy could be at risk.

You would think that Germany, with its strong economy and growth, was the lucky country, but with their rigid belief that the only way out of this mess is very severe belt-tightening there is a significant risk that they will be alienated within Europe by all the weaker countries that become fed up of being told what to do. Then we have the unpleasant possibility of extreme right and left parties becoming increasingly popular with escalating civil unrest.

We are in very interesting economic times. No-one seems to have any idea what is going to happen but my opinion is that if I go to Italy for my summer 2013 holiday, I will be asking for Lira when I buy my currency.by Hannah Gent

You would think that Germany, with its strong economy and growth, was the lucky country, but with their rigid belief that the only way out of this mess is very severe belt-tightening there is a significant risk that they will be alienated within Europe by all the weaker countries that become fed up of being told what to do. Then we have the unpleasant possibility of extreme right and left parties becoming increasingly popular with escalating civil unrest.

We are in very interesting economic times. No-one seems to have any idea what is going to happen but my opinion is that if I go to Italy for my summer 2013 holiday, I will be asking for Lira when I buy my currency.by Hannah Gent

A brilliant follow on from you last article, I like how you explain the situation of different countries in Europe. I really think you could get a top job regarding these topics, good luck!!

ReplyDelete